If you are new to The Rhythm of the $ystem, go ahead and check out the beginning of the series where I introduce The Economy Tracker. Doing so will help you better understand the information in this post:

What Matters Now

This post covers four of the most significant factors to keep an eye on now. They are:

Inflation

Yield Curves

Guidance during Earnings Season

Stock Markets

A Quick Refresher

According to The Economy Tracker, the US Economy is currently in the Economic Slowdown phase of the credit cycle. This is a late-cycle phase which is preceded by an economic Expansion and is typically followed by a Recession.

Keeping an eye on the following will help you anticipate the health of the economy in the coming months.

Inflation

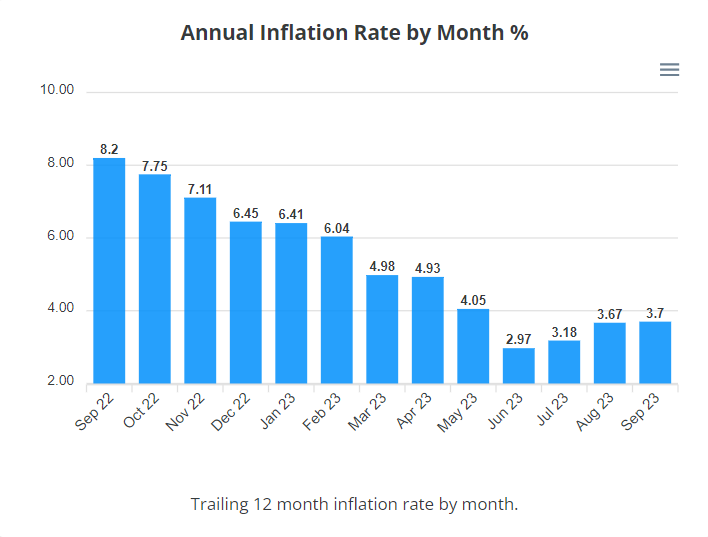

As the saying goes, “Once is an occurrence. Two times in a row could be a coincidence. Three times in a row is a new trend.” We almost got a new trend higher with September’s CPI (Inflation) print, but ended up being flat when compared to August.

*Image and chart courtesy of SlickCharts

It is crucial that inflation does not creep back up to the 4% mark when the next print comes out Tuesday morning, November 14th. Other than the obvious negative implications of further higher prices on goods and services, it would also mean that the downtrend in inflation has been broken and a new uptrend has begun. This would drastically increase the odds that The Fed will be forced to once again raise interest rates.

Once the fight against inflation begins to be won, it is imperative not to give up any ground. If that happens, interest rates will remain higher for longer. Higher interest rates and higher inflation will result in the economy staying weaker for longer.

You do not want to see old narratives become new again at the tail-end of the credit cycle. Especially when that narrative is the economy’s arch nemesis growing stronger.

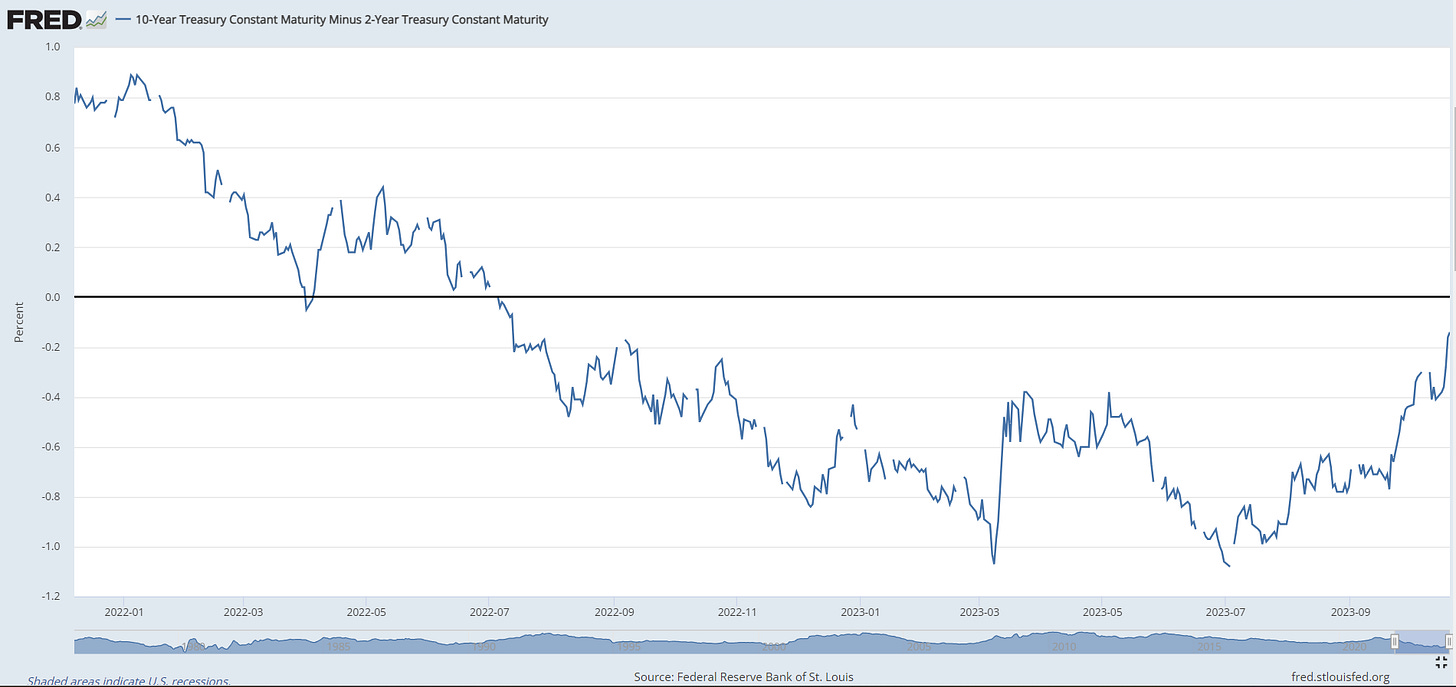

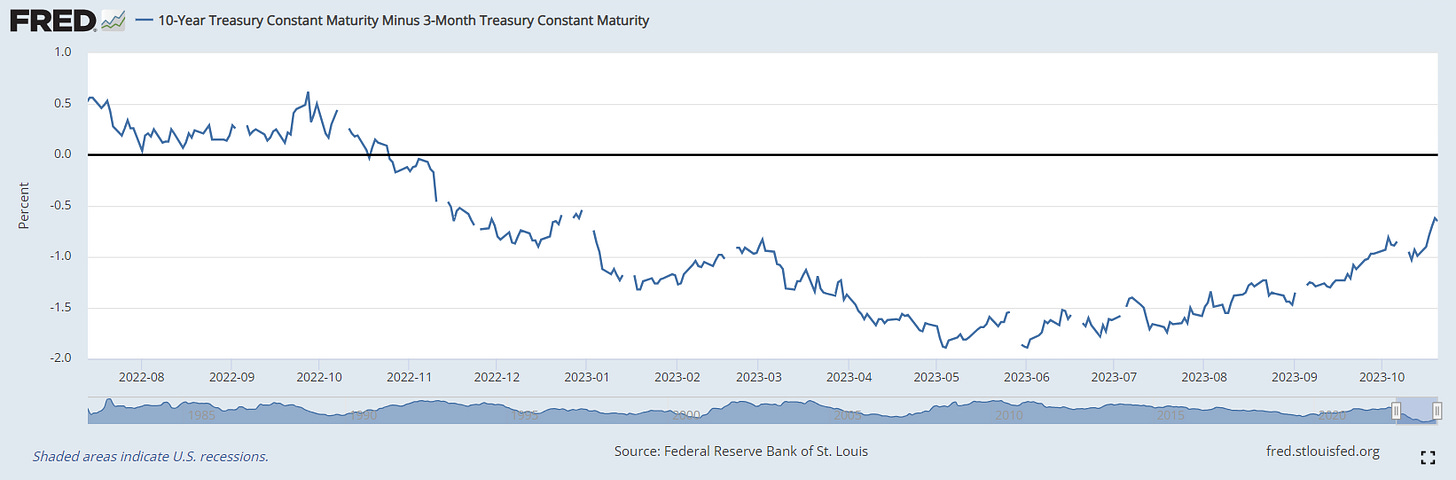

Yield Curves

With Yield Curves beginning to “steepen” after inverting (below 0.0 on the charts) and then flattening, it appears that the bond markets are finally close to getting back into proper alignment. Meaning longer terms yields (interest paid) will once again begin paying more than shorter term yields.

Historically this happens before and continues through a recession.

Best case scenario is that this trend continues, as that will mean that the economy is closer to ending the current cycle and moving into a new one.

*Image and chart courtesy of the FRED

*Image and chart courtesy of the FRED

Earnings Season

We are currently in the middle of Earnings Season, which is when the majority of publicly owned companies report their quarterly earnings. While it is always important to learn how the majority of companies performed in the previous quarter, you also want to be aware of how they are “guiding” during the Slowdown. Meaning, how profitable they think they will be in the upcoming quarters. Be on the lookout for headlines of major companies (Apple, Nvidia, UPS, FedEx, Chevron, Amazon, John Deer, Caterpillar, etc) warning of diminishing performance in the coming months due to a weakening economy. In the latter stage of a Slowdown, this could signal that a recession is close.

Stock Markets

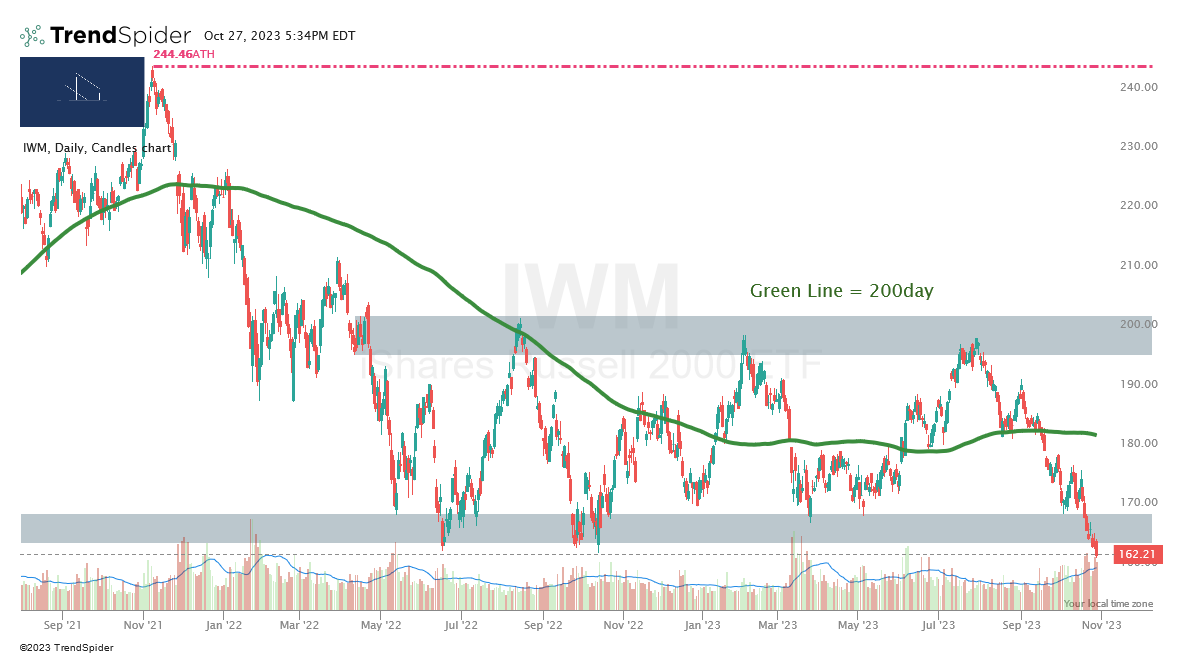

As of this writing, three out of the four major US stock markets are firmly below their 200day moving average, and all are trending down while putting in lower lows and lower highs. This is something to pay close attention to as stock markets are typically about six months ahead of the economy.

Major market selloffs at the end of cycles typically come in two waves. We experienced the first in 2022, and it appears that the second one is now underway. While it is normal and healthy for the markets to fluctuate, late-October is typically when they begin strengthening for their strongest period of seasonal strength into the new year. Instead, they are rapidly weakening.

This coupled with a strong dollar and gold prices trending higher tells you that market movers are opting to park their cash in safer assets instead of buying stocks when they typically do so aggressively.

If this does not change quickly, then a recession could very well be close at hand. One thing is certain, how the stock markets perform in the month of November will give us a great idea of how healthy the economy will be in first part of the new year.

While a rally in November is expected due to current oversold conditions in the markets, how strong or weak they close out the month is what’s significant.

Bottom Line

This is not the time sit around and hope for the best. It is THE time to batten down the hatches financially and secure what you have worked so hard to attain. Should the best case scenario play out, you’ll be in a stronger position when the time is right. However, if the worst case scenario plays out, it’s going to hurt far worse if you overextend yourself now. The current risk/reward is at one of the worst points in the cycle. Even if the economy gets a last second “kick save” and grows significantly here, it will result in inflation roaring back to life.

What Happens Next?

So much pessimism, but it’s not all doom and gloom on the horizon.

In the next post I’ll point out what the more than likely outcome is should the current progression of the economy remain intact.

Spoiler Alert: It’s actually not that bad and far from the worst case scenario.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart) button.

To stay up to date on this journey, hit Subscribe now if you are not yet subscribed.

Click the Leave a comment button if you have any questions, comments, or need something clarified. Don’t be shy. The main point of “The Rhythm of the $ystem” is to constantly improve. Questions and comments help us both.

If someone you know might be interested in this post, go ahead and click Share.

If someone you know might be interested in this subject, go ahead and click Share The Rhythm of the $ystem.

Learn. Improve. Pass on.