2024 Forecast

What to expect and watch out for in 2024.

Continued Economic Strength and Growth

Use Seasonality as long as it continues to work

Let Sector Rotation be your guide

Tons of cash on the sidelines

Events that would change this forecast

What to expect from Interest Rates

Prediction/Best guess for where the S&P500 gets in 2024

2024: Stock Markets continue higher and the Economy grows

Whether you want to believe it or not, stock markets are performing as perfectly as you hope they would in a bull market.

But it’s not just the markets. No, even the economy is now pumping out data one would expect out of the early part of the expansion phase.

If this is hard to believe, then remember that there is still stimulus from both the Inflation Reduction Act and the Chips Act coursing through the economy’s veins. Capital moves markets, not opinions based on “asset prices are too high.” Read some old market and economic periodicals from decades ago and you will see one of the consistencies is people are always complaining about higher prices of assets and saying that it can’t continue. Don’t fall for this surface-level thinking nonsense.

Use Election Year Seasonality as a guide until it stops working

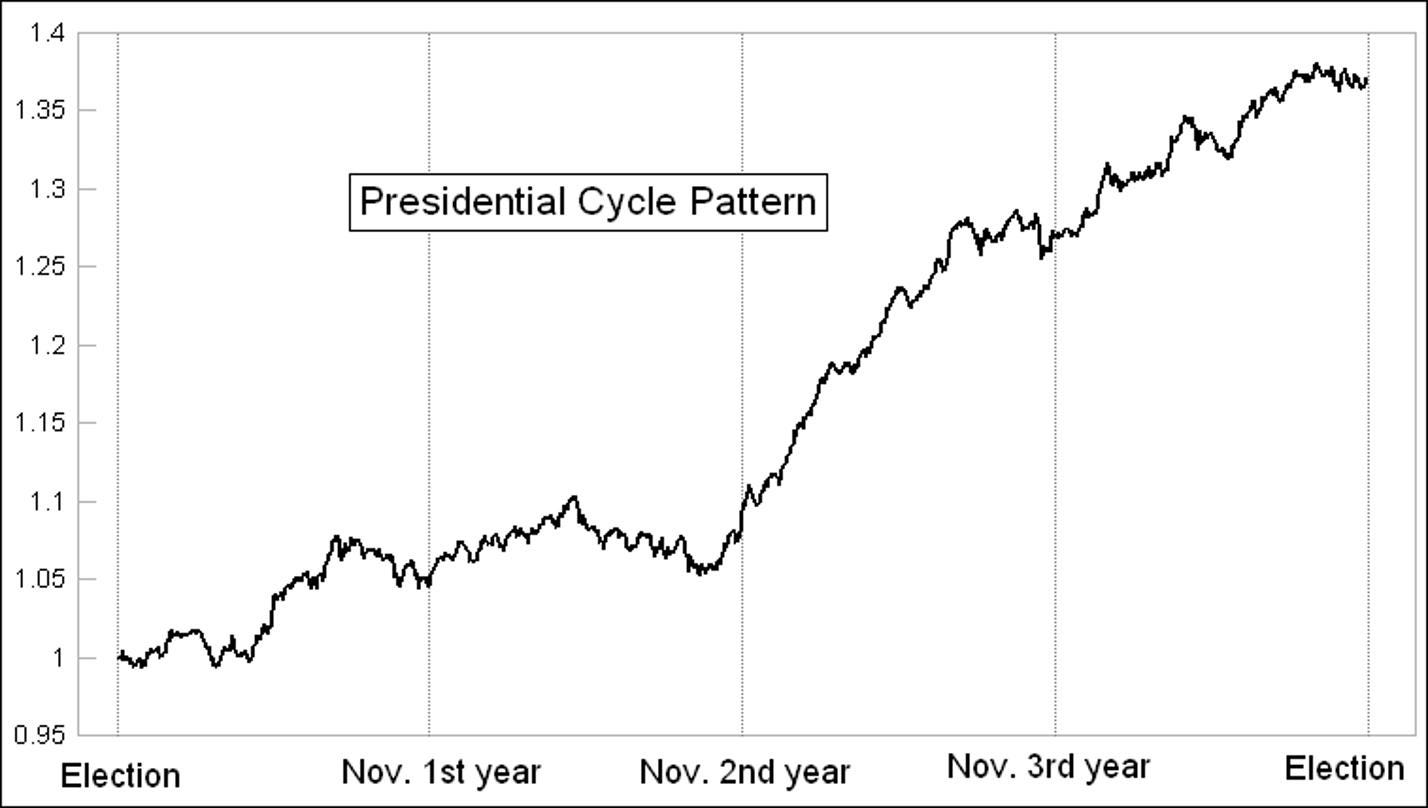

The seasonality of the 4-year presidential cycle has been playing out perfectly since markets bottomed on Oct 13th, 2022.

At this point, the only knock on how well Seasonality has been performing is that it has been damn near perfect. It’s worked so well, that it’s a little troubling. But there’s always a negative to be found and I’ll take this one every time.

Rotation is Leading the Way

One of the signs of a healthy bull market and thus a healthy economy is rotation into more risk-on sectors. After Technology, Consumer Discretionary, Communications, and Real Estate lead as they did in 2023, you want to see Financials, Industrials, and Materials continue to move up the list this year.

Most importantly, you want Utilities and Consumer Staples to continue underperforming most of the field, as has been the case.

Tons of cash on the sidelines

As of this writing, there is still over $4 Trillion which can be deployed to assets. This creates a cushion for markets when they do retrace as well as adding to demand as prices continue to move higher.

What Changes the Current Path

One way to separate a professional from a run-of-the-mill clown giving an unsubstantiated opinion is that the professional can tell you where their thesis is wrong. A clown does not think they can be wrong and will make up excuses about why their guess is not working out.

***Write that one down. It is vital to understanding who knows what they are doing and who is a charlatan.***

With that being said, here is what you want to watch for a possible change of trend.

Biden drops out.

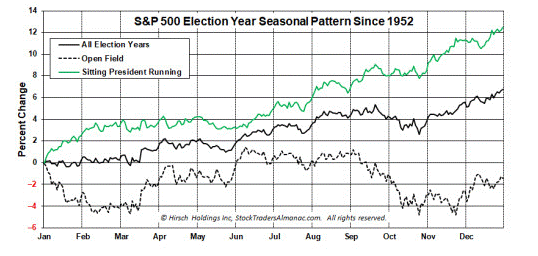

If you’re laughing and/or incredulous about this, you do not understand how markets and the economy work. Markets hate nothing more than uncertainty, and right now we have two former presidents running for a final term. This means that traders and well-run businesses know what to expect out of both. If the presidential election participants change, expect markets and the economy to retrace heavily and take a “wait and see” approach.

“Waiting to see how the election turns out” when an incumbent is running is an unforced error that stems from inexperience and/or a lack of studying history.

Bonds begin to outperform stocks.

This is typically seen during the end of cycles and is a flight to safer assets.

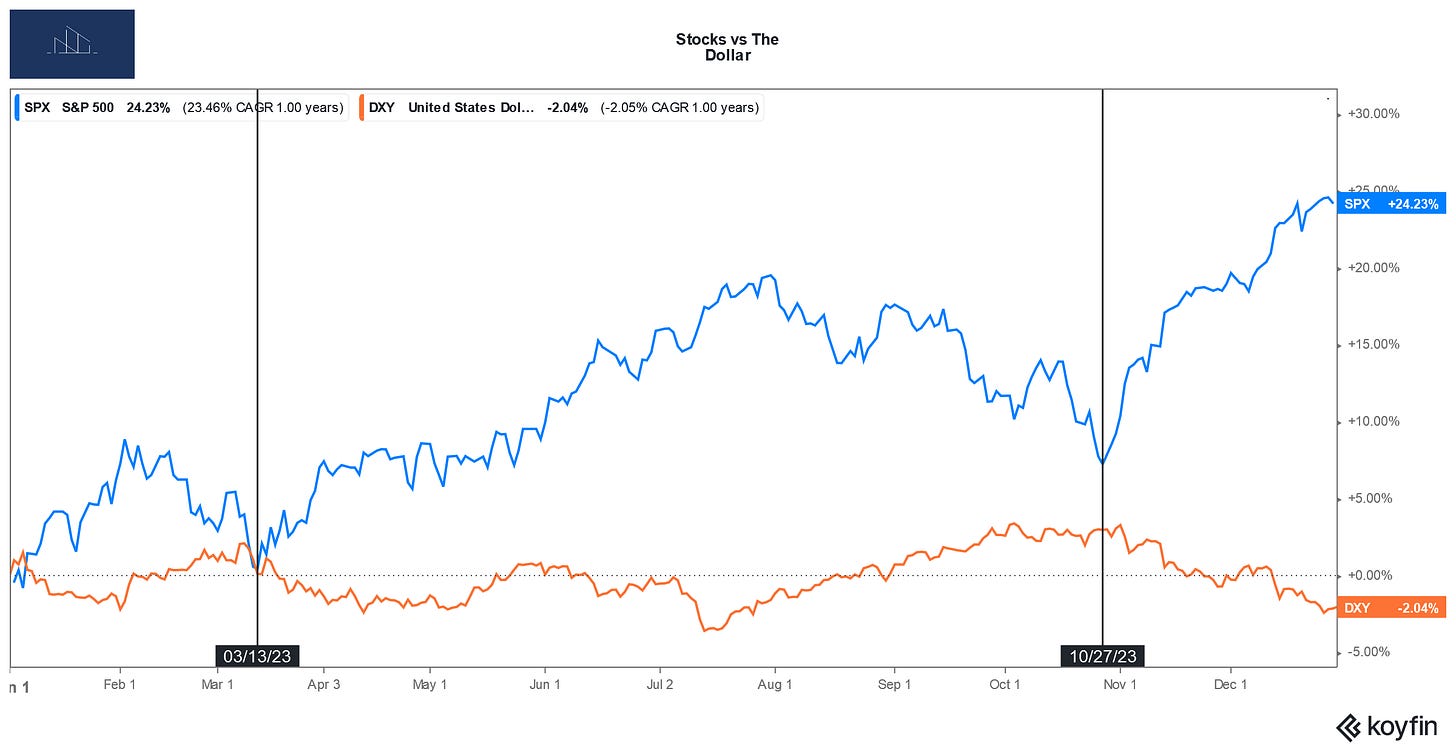

The Dollar rips higher.

There has been a clear inverse relationship between the performances of stocks and the dollar.

Another wave of inflation caused by the Suez and Panama Canal issues.

The ongoing severe drought in the Panama Canal was bad enough. Now, ships are being attacked in the Suez Canal which is also driving up shipping costs. If this continues over the coming months, the higher shipping costs will eventually begin to drive up the costs of goods.

The Dreaded Black Swan Event

Black Swan events are unknown beforehand and are therefore unpredictable. Markets and the economy are at risk of a black swan 100% of the time, so it makes zero sense to be afraid of them and allow that fear to drive your behavior.

Examples of Black Swans are the Flash Crash of 2010 and the terrorist attacks on 9/11. Even then, someone always seems to know something. As evidenced by the huge amount of puts bought in United and American Airlines the week leading up to 9/11.

What to expect for rate cuts in 2024

1% - 1.5% in cuts beginning as early as May, but maybe as late as July.

It takes a special kind of arrogance to predict where the S&P500 will hit in the coming year.

With that, look for the S&P500 to hit 5500 by the end of the year. (SPY at $550)

But First, A Retracement

Markets have been on fire since the end of October. Just like a person who has exerted a bunch of energy in a relatively short amount of time, markets also need to take a breather, rest up, and get ready for the next big push.

This coupled with seasonality has me expecting a healthy retracement beginning around mid-February. I would then expect this to bottom out sometime in or around May for a charge higher into the end of the year.

Of course, there will be healthy retracements along the way, as markets do not move in straight lines. However, the current aggregated signs definitively indicate the main trend remains higher. As long as that continues, the economy stays healthy and expanding.

Enjoy the Good Times

The positive momentum is obvious unless you get your economic information from headlines and corporate media. Everything that you want to see happening for the bull market and expanding economy to continue is doing so. If that changes, we’ll know about it when most people figure out that things began improving in October 2022.

While markets and the economy are moving in the right direction, it’s still a good idea to use this second growth wave of the cycle to pad those bank accounts as much as possible. Even though momentum is on our side, the path has been a little weird. Sometimes that can be an early warning sign for something big and unpleasant in the coming years. If that is the case, we will be some of the earliest people to know.

There is plenty of time to deal with that when the time is right. But for now, be sure to enjoy the good times while they are present.

If you enjoyed this post or found it useful, do me a favor and hit the like (heart) button.

Click the Leave a comment button if you have any questions or comments, or need something clarified. Don’t be shy. The main point of “The Rhythm of the $ystem” is to improve constantly. Questions and comments help us both.

If you are new to The Rhythm of the $ystem, go ahead and check out the beginning of the series where I introduce The Economy Tracker. Doing so will help you better understand the information in this post:

Learn. Improve. Pass on.